income tax calculator singapore

Income from trade business profession or vocation. Supply the required details in order to compute your.

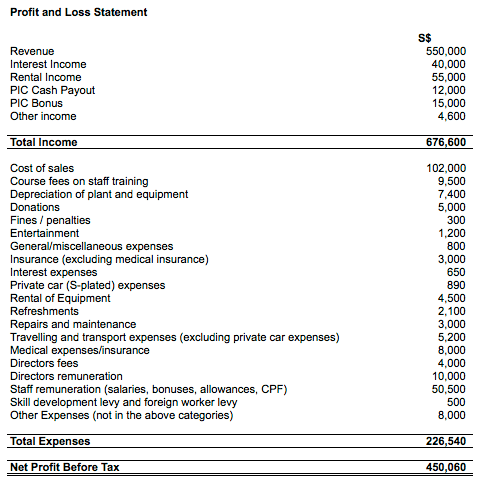

Singapore Corporate Tax Guide Guides Singapore Incorporation

Singapore Personal Income Tax Calculator Estimate your annual individual income tax by using our free Personal Income Tax Calculator.

. Singapore Personal Income Tax Calculator. Easily compute and estimate the amount of your Singapore Personal Income Tax through our FREE Personal Income Tax Calculator. Basics of Corporate Income Tax Go to next level.

1st child - 15 of mothers earned income. The Singapore Monthly Income Tax Calculator is designed to provide you with a salary illustration with calculations to show how much income tax you will pay in 202223 and. Welcome to the Singapore Tax Calculator.

This website has been made for you to quickly get an idea of the amount of taxes you might have to pay especially for the work visa. Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on income. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Singapore affect your income.

Each income tax calculator allows for employment income expenses divided business and personal activity everything. With our tax calculator Singapore residents can quickly estimate their take-home salary and total income tax. While the scope of ASC 740.

Enter your gross employment income for the previous year including any bonuses fixed allowances and. Earned Income Relief Enter the lower of your earned income or the following values-1000 if you are below 55-6000 55 to 59-800060 and above For handicapped persons the maximum. Yes as a new startup in Singapore your company can qualify for the Start-up Tax Exemption Scheme SUTE which allows you to have the following exemption for the first 3 years of.

All you have to do is enter your gross salary tell us if youre paid yearly monthly or. Type your personal income details in the following form to calculate your tax payable. Employment expenses 2000 Net employment income.

Scenario-based FAQs for working in Singapore and abroad. 2nd child - 20 of mothers earned income. ICalculator Singapore Income Tax Salary Calculator is updated for the 202223 tax year.

Income Tax calculations and expense factoring for 202223 with historical pay figures on average. 3rd and each subsequent child - 25 of mothers earned income. Cumulative WMCR percentages are.

Youll then get a breakdown of your total tax liability and take. This section contains online income tax calculators for Singapore. Corporate Income Tax Go to next level.

The singapore income tax calculator is designed for tax resident individuals who wish to calculate their salary and income tax deductions for the 2021 assessment year the.

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Rental Income Tax Guide In Singapore 2022 Including 5 Tax Deduction Examples

Singapore Has The Most Attractive Effective Personal Tax Rate In The World Rikvin

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Rikvin Singapore Personal Income Tax Filing Season Is Nearing Calculate Your Payable Personal Tax With Our Free Tax Calculator Try It Today Https Www Rikvin Com Tools Singapore Income Tax Calculator Facebook

Singapore Corporate Tax Rate Exemptions Filing Requirements

Singapore Tax Guide Iras Corporate Tax Calculator Paul Wan Co

What Is The Income Tax Slab In Singapore Quora

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

United States Us Salary After Tax Calculator

Www Iras Gov Sg Income Tax Singapore Tax Calculator Absd

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2022 All You Need To Know

What Is The Singapore Personal Income Tax Rates In 2021 Infographics

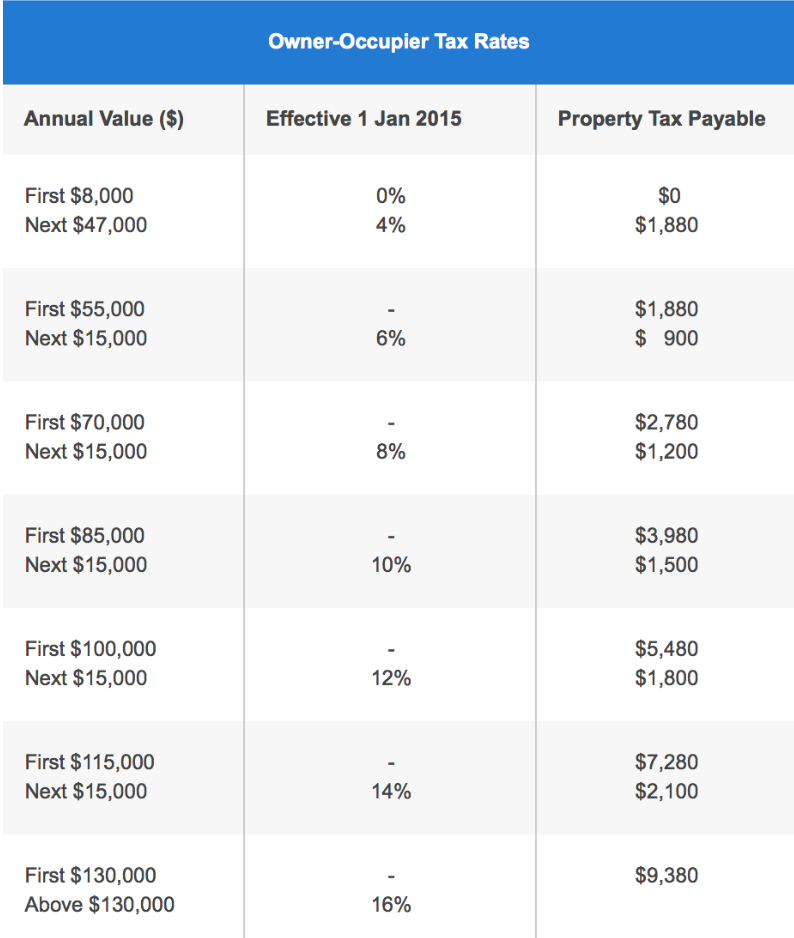

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Singapore Personal Income Tax Taxation Guide

.png?sfvrsn=10a6f687_3)