does texas have a death tax

Final individual federal and state income tax returns. The federal estate tax return is due within nine months of your death.

2020 State Guide To Scattering Ashes Texas Edition

A transfer on death deed has no legal effect during the owners life so state ad valorem property tax exemptions are not affected.

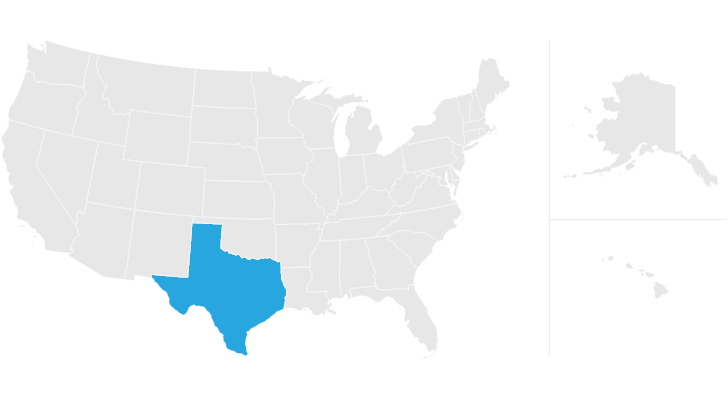

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas is one of the states that do not collect estate taxes. However Texas does have the sixth highest property tax rate in in the US.

These reasons and cases are the following. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. The Texas Probate Code Title 2 Subtitle E Chapter 201 is the law.

Only 12 states plus the District of Columbia impose an estate tax. What are the state and federal tax consequences of a Texas TODD. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed.

That said you will likely have to file some taxes on behalf of the deceased including. New death sentences in Texas have decreased since peaking in 1999 when juries sentenced 48 people to death. Theres no estate taxin Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022.

There are no inheritance or estate taxes in Texas. Each state controls the functioning of this process through the intestacy succession laws found in that states probate tax code. There is a 40 percent federal tax however on estates over 534 million in value.

At 183 compared that to the national average which currently stands at 108. Six additional states also levy an inheritance tax. Right now there are 6 states that have an inheritance tax.

The 2017 tax reform law raised the federal estate tax exemption considerably. If you die with a gross estate under 114 million in 2019 no estate tax is due. In the Texas statutes there are only 9 reasonscases that an inmate can receive the death penalty.

Your will does not have the ability to disperse all your estates property due to. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes. The court will appoint an executor to manage the estate during this process.

Property Taxes in Texas. TRS will require the name address and telephone number of a family member friend or other person who can act as a contact for TRS as well as the TRS participants date of death. After grinding to a halt in 2020 because of the pandemic capital jury trials involving the death penalty resumed in the second half of 2021.

UT ST 59-11-102. Does texas have a death tax Tuesday May 31 2022 Edit. No not every state imposes a death tax.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use. Texas does not have an estate tax either. A six-month extension is available for this return as well.

Does Texas Have an Inheritance Tax or Estate Tax. TRS may be notified by calling toll-free at 1-800-223-8778. Murdering a public safety officer Intentionally murders a during a burglary kidnapping arson aggravated sexual assault retaliation terroristic threat and robbery.

Death sentences have remained in the single digits for the past six years. The only types of taxes that apply in Texas after a person dies are income taxes gift taxes property taxes and federal estate tax. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. Death Taxes in Texas Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance taxon September 15 2015. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate.

Tax is tied to federal state death tax credit. At that time TRS will request that a copy of the death certificate be provided when it becomes available. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

On the one hand Texas does not have an inheritance tax. When a Texas resident dies without having made a last will and testament they are automatically entered into the states intestacy probate process. After the homeowners death if the estate cannot pay the property taxes interest and penalties then the taxing authority becomes a creditor of the estate and can request that the home be sold to pay the amount due.

Call or Text 817 841-9906. There is a 40 percent federal tax however on estates over 534. If your gross estate is over 114 million you pay a tax on the overage.

There is a Federal estate tax that applies to estates worth more than 117 million. Dying Without a Will If you die without a will in the state of Texas and your estate is worth more than 75000 it will go into probate. 600 AM on Feb 9 2020 CST.

The state repealed the inheritance tax beginning on Sept. The Texas Franchise Tax. Transfer on death deeds legal in Texas since 2015 have been heralded as the latest greatest method for keeping real property out of.

A surviving spouse between the ages of 55 and 65 can keep the decedents exemption by applying at their local tax appraisal office. Prior to September 15 2015 the tax was tied to the federal state death tax credit. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania.

Property conveyed by a Texas TODD is treated the same as probate property so beneficiaries receive a stepped up federal basis. Before that law was enacted the exemption was 549 million per person for decedents who died in 2017. If your gross estate is over 114 million you pay a tax.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Como Puedo Probar La Herencia En Texas Tax Protest Protest Property Tax

Pin By ˢᵗᵉˡˡᵃʳ ᵈᵃʳˡᶤᶰᵍ On Art Stuff Stupid Funny Memes Funny Relatable Memes Funny Memes

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Recipe Texas Sheet Cake Sheet Cake Recipes Texas Sheet Cake Recipe Sheet Cake

Texas Inheritance Laws What You Should Know Smartasset

Absentee Owners In Texas Offer Support To The Tenants Chicago Real Estate Real Estate Estate Law

Plano Tx Homes And Real Estate For Sale